@ Gorodenkoff/stock.adobe.com

@ Gorodenkoff/stock.adobe.com

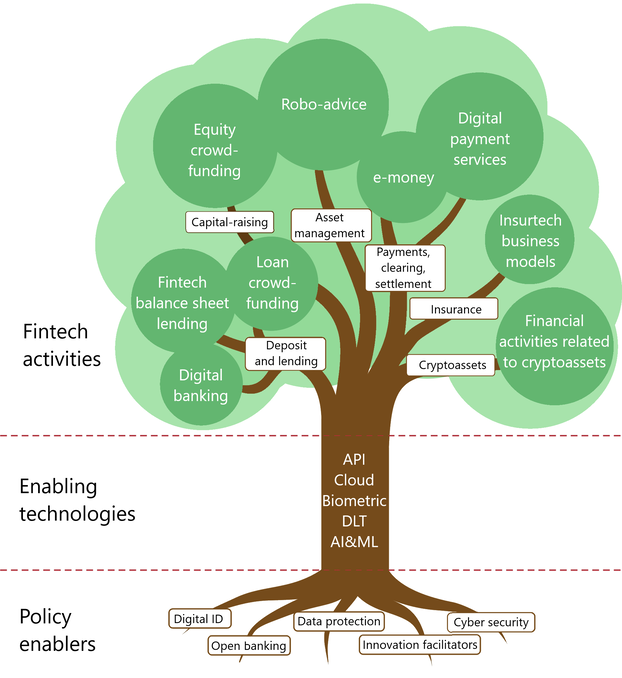

Topic Fintechs Fintech business models

Fintech business models are diverse and – depending on their structure – may also require authorisation from BaFin.

On the following pages, you can find an overview of the current most frequent business models, alongside supervisory information.

- execution of orders in crypto assets on behalf of third parties;

- advice on crypto assets;

- operating a trading platform for crypto assets;

- placing of crypto assets;

- exchange of crypto assets for other crypto assets;

- exchange of crypto assets for fiat currencies that constitute legal tender;

- custody and management of crypto assets on behalf of third parties.